CVEX (Crypto Valley Exchange)

Pascal Protocol / Jetstream Trading

Company

Decentralised

Television Appearances

CNBC Crypto World

Bitcoin rebounds from weekend sell-off after Trump pauses Mexico tariffs (February 3, 2025)

https://www.cnbc.com/video/2025/02/03/bitcoin-rebounds-from-weekend-sell-off-after-trump-pauses-mexico-tariffs-crypto-world.html

Bitcoin drops to $67,000 level and Gemini returns more than $2 billion to users (May 29, 2024)

https://www.cnbc.com/video/2024/05/29/bitcoin-drops-to-67000-level-and-gemini-returns-more-than-2-billion-to-users-cnbc-crypto-world.html

Video Interviews

YouTube Interview

https://www.youtube.com/watch?v=vMsPp2e0Bsw

Twitter/X Spaces & Podcasts

Mario Nawfal - The Roundtable

X Space Appearance (February 13, 2025)

https://x.com/MarioNawfal/status/1890107032558285178

Major News Coverage

CoinDesk

Crypto Valley Exchange Bets 'Smart Clearing' Is DeFi Derivatives' Missing Link (April 11, 2025)

Feature article by Danny Nelson with direct quotes from James Davies as CEO

https://www.coindesk.com/business/2025/04/11/crypto-valley-exchange-bets-smart-clearing-is-defi-derivatives-missing-link

Crypto Valley Exchange to Go Live in January With Cheap On-Chain Futures and Options Trading (November 19, 2024)

Direct quotes from James Davies as CEO

https://www.coindesk.com/business/2024/11/19/crypto-valley-exchange-to-go-live-in-january-with-cheap-on-chain-futures-and-options-trading

The Block

Decentralized exchange CVEX raises $7 million ahead of upcoming mainnet launch (April 16, 2024)

https://www.theblock.co/post/288607/decentralized-exchange-cvex-raises-7-million-funding-round-ahead-of-upcoming-mainnet-launch

Yahoo Finance

Crypto Valley Exchange Raises $7 Million to Launch the Most Capital-Efficient Digital Asset Derivatives Trading Platform (April 16, 2024)

https://finance.yahoo.com/news/crypto-valley-exchange-raises-7-161500220.html

PR Newswire

Pascal and Treehouse Partner on Proof of Concept to Pioneer Smart Clearing for Decentralized Fixed Income Products (August 27, 2025)

https://www.prnewswire.com/news-releases/pascal-and-treehouse-partner-on-proof-of-concept-to-pioneer-smart-clearing-for-decentralized-fixed-income-products-302539830.html

Industry Media & Interviews

John Lothian News

James Davies of Tacans Interview (2023)

Video interview discussing Tacans, derivatives, DeFi, and TradFi

https://johnlothiannews.com/look-whos-talking/

Arbitrum Blog (Case Study)

How Pascal is Building the Clearinghouse for Onchain Finance (September 4, 2025)

Technical deep-dive featuring Pascal Protocol

https://blog.arbitrum.io/how-pascal-is-building-the-clearinghouse-for-onchain-finance/

Profile Pages & Directories

CryptoSlate People Directory

Verified profile with career history

https://cryptoslate.com/people/james-davies/

The Org

Organisation chart and biography

https://theorg.com/org/crypto-valley-exchange-protocol-cvex/org-chart/james-davies

MarketsWiki (John Lothian)

Historical profile from LDX/GMEX period

http://www.marketswiki.com/wiki/James_Davies

Conference Appearances

Consensus 2023 (Austin, TX)

Panel discussion with Marie Tatibouet covering DeFi, liquidity, decentralized exchanges, and global crypto regulations

Fabric Summit

CEO participation with portfolio company showcase

DATEs

March 2023 - November 2025

STATUS

Offline, trying to revitalise

Summary

Pascal Protocol and Jetstream represent three years of intensive R&D applying traditional clearing house methodology to decentralised finance — solving the capital efficiency problem that has constrained professional participation in on-chain derivatives markets. How do you create Wall Street and the City of London on-chain.

This project involved substantial scientific and technological uncertainty, requiring the development of novel computational approaches to portfolio risk calculation, the adaptation of established financial models for blockchain execution constraints, and the creation of new cryptographic verification systems for off-chain computation.

Handleport Limited's participation has been through IP development, technical advisory services, and protocol contributions — compensated through a combination of protocol tokens rather than conventional employment relationships.

The Problem: Why Existing Infrastructure Fails

Capital Inefficiency in DeFi Derivatives

Existing DeFi derivatives platforms (perpetual swaps, options protocols) require isolated margin per position. A trader with offsetting risk across multiple instruments must post full collateral for each — capital inefficiency that makes professional market-making uneconomic compared to centralised alternatives.

Example: A market maker with:

Long 100 BTC calls at $70,000 strike

Short 100 BTC calls at $72,000 strike

Under isolated margin, must post collateral for both positions independently. Under portfolio margining, the hedged position requires dramatically less capital because the risk offset is recognised.

The Capital Efficiency Gap

ModelCapital RequiredCapital EfficiencyIsolated Margin (DeFi standard)100% per position0% offsetTraditional CCP Portfolio Margin10-30% of notional70-90% offsetPascal Protocol15-35% of notional65-85% offset

Traditional finance solved this decades ago through central counterparty clearing: portfolio margining, cross-margining, and netting reduce capital requirements by 70-90% for hedged portfolios.

No existing on-chain protocol provided equivalent functionality before Pascal.

Technical Innovation: Core R&D Areas

1. QUBO-Based Portfolio Risk Calculation

The Fundamental Challenge:

Traditional Value-at-Risk (VaR) portfolio margining uses Monte Carlo simulation — computationally expensive methods that require overnight batch processing. This approach is incompatible with 24/7 blockchain markets requiring continuous margin updates.

The Innovation: Quadratic Unconstrained Binary Optimization (QUBO)

Pascal uses QUBO algorithms for real-time portfolio risk assessment — framing portfolio risk calculation as an optimisation problem finding worst-case loss across correlated market scenarios.

Mathematical Specification:

Maximize: L = X^T Q X

Where:

- X = binary vector of included/excluded positions

- Q = covariance matrix of position returns

- L = worst-case portfolio lossWhy QUBO:

Combinatorial Explosion Management: With N positions, there are 2^N possible loss configurations. For a 50-position portfolio: >1 quadrillion configurations. QUBO provides near-optimal solutions in milliseconds rather than hours.

Correlation Captures Reality: Unlike bucketing approaches (CME SPAN), QUBO naturally models how positions move together under stress.

Non-Linear Risk Handling: Options gamma, vega require considering portfolio-level interactions, not just position-by-position summation.

Technical Complexity:

Base computational complexity: O(n²) for n instruments (covariance matrix)

Gas minimisation through path routing optimisation

Verifiable proof generation for on-chain validation

NP-Hard problem class requiring quantum-inspired classical solving

R&D Challenge: Adapting quantum-inspired optimisation algorithms for deterministic blockchain execution while maintaining verifiable correctness guarantees.

2. Student-t Distribution Fat-Tail Modelling

The Problem: Standard Gaussian VaR models systematically underestimate tail risk in cryptocurrency markets. Extreme moves (>5σ) occur far more frequently than normal distribution predicts.

Per-Instrument VaR Calculation:

VaR_i = Position_i × Price_i × t-quantile(α, df) × σ_i

Where:

- α = confidence level (typically 99%)

- df = degrees of freedom (captures tail risk)

- σ_i = volatility of instrument iEmpirical Validation:

Backtesting against historical stress scenarios shows Student-t with df=6-8 provides:

99% VaR exceedances: 1-2% (close to theoretical 1%)

Gaussian 99% VaR exceedances: 5-7% (massive underestimation)

R&D Achievement: First on-chain risk model implementing fat-tail distributions with continuous recalibration based on market regime detection.

3. Verifiable Off-Chain Computation Architecture

The Constraint: QUBO problems are too computationally heavy to solve natively on-chain within Ethereum block times and gas limits.

The Innovation: Pascal supports a verifiable off-chain solving architecture where:

QUBO problems are formulated on-chain with full parameter transparency

Solutions computed off-chain by distributed solvers

Results submitted on-chain via oracle mechanism

Protocol verifies constraints and consistency deterministically

Outcomes auditable without trust assumptions

Technical Implementation:

Arbitrum One (L2) for collateral pool integrity and settlement

Arbitrum Orbit (custom chain) for high-frequency risk calculations and clearing logic

Cryptographic proof submission for computation verification

Decoupled mark prices from order book to prevent manipulation

R&D Challenge: Creating trustless verification schemes for complex numerical optimisation without requiring full computation replication on-chain.

4. Non-Markovian VaR Models for Blockchain

Traditional VaR assumes:

Stationary correlation structures

Time-independent volatility

Markovian (memoryless) price processes

Cryptocurrency markets exhibit:

Regime-dependent correlations

Volatility clustering

Long memory in return distributions

Pascal Innovation:

Rolling 90-day historical windows with hourly observations

Volatility weighting (recent data weighted exponentially)

Regime detection for high/low volatility states

Dynamic correlation matrix updates via oracle feeds

R&D Achievement: First implementation of adaptive non-Markovian risk models within gas-constrained blockchain execution environments.

5. Delta Collapse and Cross-Offset Methodology

The Problem: Options positions have non-linear payoffs that cannot be simply summed for portfolio margining.

The Solution:

Options positions are reduced to delta equivalents through a normalisation process:

Gamma Load Adjustments: Account for convexity in option values

Deep ITM Options: Collapsed to delta-one (equivalent to underlying)

Deep OTM Options: Notional scaled to true expected exposure

Volatility Spread Correlation: Second-order risk factor tracking regime shifts

Cross-Offset Implementation:

Normalise non-linear products into risk vectors

Net long/short deltas across product types

Offset based on correlation matrix, not naive heuristics

Concentration scaling for oversized positions

R&D Achievement: First DeFi implementation combining Student-t VaR, QUBO portfolio solving, and non-linear options normalisation in a single integrated system.

Investors -(Token prebuying)

Lars Seier Christensen

Co-founder of Saxo Bank, the Danish investment bank and online trading platform. Lars has been an active investor in blockchain infrastructure projects and brought both capital and strategic guidance to the Pascal development effort. His experience building regulated trading infrastructure provided valuable perspective on institutional adoption requirements.

SALT Fund (Anthony Scaramucci)

SkyBridge Capital's SALT Fund, led by Anthony Scaramucci, participated in Pascal's funding rounds. SALT has been active in digital asset infrastructure investments, and their involvement provided connections to traditional finance networks and potential institutional users.

Fabric Ventures

European venture capital firm focused on open-source networks and decentralised infrastructure. Fabric brought deep expertise in protocol economics and tokenomics design, contributing to Pascal's governance structure and incentive alignment.

Wave Digital Assets

Digital asset investment firm specialising in blockchain infrastructure and DeFi protocols. Wave's portfolio focus on derivatives and trading infrastructure aligned directly with Pascal's market positioning.

FunFair Ventures

Investment arm originating from FunFair Technologies, with experience in Ethereum-based protocol development and smart contract architecture. Their technical due diligence provided validation of Pascal's approach to on-chain clearing.

AMDAX

A Dutch regulated digital asset exchange and custodian — one of the first to receive DNB (De Nederlandsche Bank) registration. Their involvement brought regulatory credibility from the European market and validated Pascal's approach to institutional-grade infrastructure. They also provided perspective on exchange integration requirements and custody considerations.

Architecture: Protocol/Platform Separation — Regulatory balance

Pascal Protocol — The Clearing Layer

Pascal is a decentralised clearing protocol that operates as infrastructure — enabling any platform to build capital-efficient derivatives products.

Core Functions:

On-chain, trustless clearing

Portfolio-based margining via VaR models

Composable reference rates and oracle integration

Automated liquidation without human discretion

Default waterfall enforcement

What Pascal Does NOT Do:

Operate exchanges or trading venues

Control user funds or execute trades

Make discretionary decisions about positions

Override automated clearing logic

Governance:

Controlled by the Pascal DAO (formerly CVEX DAO):

Parameter updates via token holder voting

Risk model configuration

Treasury allocation

Protocol upgrades

The DAO cannot interfere with live clearing operations once trades are submitted.

Jetstream — The Platform Layer

Jetstream is the reference trading platform built on Pascal — demonstrating the protocol's capabilities.

Functions:

Trading interface and portfolio dashboards

Order routing and execution

User onboarding (KYC/AML where jurisdictionally required)

Market listing and instrument configuration

Liquidity programs and market maker support

Separation of Concerns:

LayerResponsibilitiesDiscretion AllowedPascal ProtocolClearing, Margining, SettlementNone — deterministicPlatform (Jetstream)Onboarding, UX, ControlsOptional, loggedDAO GovernanceParameters, UpgradesConstrained by process

Operational Independence:

Jetstream is operated independently from CVEX Labs AG. Multiple platforms can be built on Pascal:

DAO-operated internal hedging desks

RWA (Real-World Asset) exchanges

Permissioned institutional-only venues

Exotic derivatives platforms

Smart Contract Architecture

Two-Layer Arbitrum Implementation

1. Collateral Pool: Arbitrum One (L2 Mainnet)

Location of all posted collateral

Deployed on Arbitrum One, Ethereum-secured L2

Anchors margining, liquidation, and P&L tracking

Verifiable, permissionless, fully on-chain

Collateral pools isolated per platform — no cross-platform risk sharing

2. Clearing, Risk & Matching: Arbitrum Orbit (Custom Chain)

Risk engine, clearing logic, and position state

Optional matching engine for native order routing

Supports both CLOB-style trading and OTC submission

High-speed margin updates and position changes

All trades must clear through Pascal's immutable risk logic

Collateral Policy

Jetstream exclusively accepts native USDC (issued directly on Arbitrum) as margin collateral:

Eliminates bridge and wrapper risk

Simplifies margin accounting

Avoids non-deterministic collateral behaviour

Decouples product risk from collateral risk

Wrapped tokens, bridged assets, or synthetic stablecoins are explicitly excluded.

Oracle Integration

Risk calculations depend on platform-selected oracles providing:

Mark price curves for each instrument and expiry

Correlation and covariance matrices for risk aggregation

Volatility surface data for options pricing

Oracle Requirements:

Transparency

Decentralisation

Auditability

Independence from order book manipulation

Operational Mechanics

Trade Lifecycle

Trade Submission: Counterparties execute trades bilaterally (OTC) or on venue

Validation: Pre-trade checks (capacity, margin impact) via risk engine

Acceptance: Trade accepted and submitted to Pascal

Position Recording: Immutable record on Arbitrum ledger

Margin Calculation: QUBO optimisation determines required collateral

Collateral Movement: Atomic settlement via smart contract

Continuous Monitoring: Real-time margin recalculation as markets move

Liquidation Process

Margin Breach Detection: Automated monitoring against thresholds

Alert Generation: Counterparty notification

Grace Period: Opportunity for voluntary collateral top-up

Liquidation Trigger: Execution via permissionless liquidation bots

Position Unwind: Order routing for position closure

Loss Allocation: Waterfall processor determines distribution

Settlement: Atomic on-chain completion

Key Protections:

Decoupled mark prices from order book manipulation

Circuit breakers during extreme volatility

Auctions to stabilise forced unwind events

Default Waterfall

In default scenarios:

Defaulting account's margin exhausted first

Platform-specific collateral pool absorbs residual

Protocol-defined loss allocation rules apply

No cross-platform contagion — risk fully siloed per venue

Market Context

Why This Matters

The crypto options market remains in a pre-clearing world:

Billions in notional traded off-chain weekly

No netting, no deterministic margin

No portfolio offsets, no system-wide transparency

Full bilateral counterparty risk

Status quo: TradFi processes from the 1980s, executed on-chain.

OTC Clearing as Go-to-Market

Most crypto options volume doesn't happen on exchanges — it happens OTC:

Token hedging for project treasuries

Structured yield notes

Block trades via brokers

Treasury protection for DAOs

Pascal + Jetstream delivers OTC execution with centralised clearing benefits:

Protocol-level margin requirements

Risk netting across strategies

Automated liquidations

Transparent, on-chain exposure state

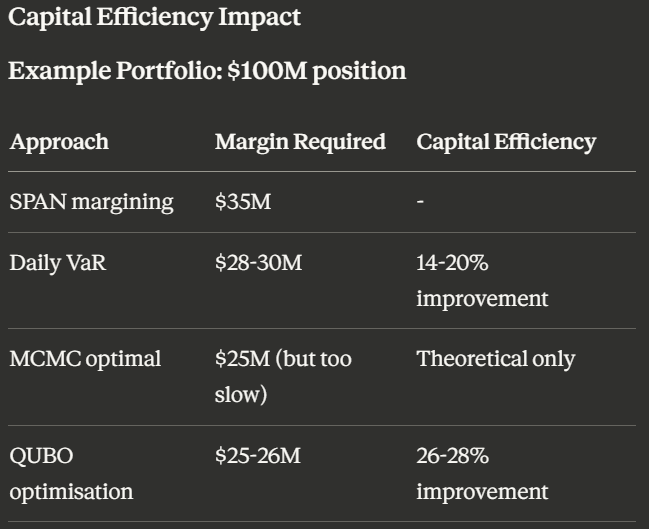

Capital Efficiency Impact

Example Portfolio: $100M position

Real-time capability: Sub-second recalculation vs. overnight batch processing.

Partnership: Block Scholes

Pascal has partnered with Block Scholes — the oracle and analytics provider behind over 80% of options DEX activity — to deliver:

Real-time verifiable pricing feeds

Institutional-grade volatility surfaces

Reference rate construction for settlement

This partnership ensures Pascal's risk calculations use the same data quality relied upon by major institutional participants.

Development Status

Completed Milestones

Pascal Protocol smart contracts deployed on Arbitrum testnet

QUBO risk engine operational with verifiable off-chain computation

Jetstream platform UI and API development

Block Scholes oracle integration

Portfolio margining across BTC/ETH options and futures

Liquidation bot infrastructure

Active Development

Mainnet deployment preparation

Additional asset support (SOL, AVAX, DeFi tokens)

Physical delivery options

Cross-asset derivatives

RWA tokenised derivatives infrastructure

Decentralised Structure & Token Economics

Governance via Pascal DAO

The Pascal Protocol is governed by a decentralised autonomous organisation (DAO):

Token holders vote on parameter changes

Multi-signature requirements for critical upgrades

Time-locked proposals with community review periods

Treasury allocation for development grants

CVEX Labs AG — Independent Contributor

CVEX Labs AG (Switzerland) is an independent contributor to Pascal development:

Provides technical development, risk modelling, and infrastructure support

Does not operate exchanges, platforms, or touch user funds

Compensated through treasury grants and token allocation

No operational control over clearing or settlement

Token-Based Compensation

Handleport Limited's involvement has been as a technical contributor and advisor to the protocol development:

Compensation: Combination of protocol tokens (CVEX) and service arrangements

Nature of relationship: IP development and technical advisory, not employment

Deliverables: Risk model specification, smart contract architecture, protocol design documentation

IP ownership: Contributed to open-source protocol codebase

This structure reflects the decentralised nature of protocol development — contributors are compensated through token allocation rather than conventional employment, aligning incentives with protocol success.

R&D Expenditure Categories

Scientific and Technological Uncertainty

The project faced substantial uncertainty in multiple domains:

1. Computational Feasibility

Whether QUBO-based portfolio optimisation could achieve sufficient accuracy within blockchain gas constraints

Whether verifiable off-chain computation could maintain trustlessness guarantees

Whether real-time risk calculation was achievable for complex portfolios

2. Financial Model Adaptation

Whether fat-tail distributions could be implemented within deterministic smart contracts

Whether cross-asset correlation matrices could be maintained accurately via decentralised oracles

Whether options delta normalisation would produce economically meaningful margin requirements

3. System Integration

Whether two-layer Arbitrum architecture would provide necessary performance

Whether oracle integration would maintain price integrity under adversarial conditions

Whether liquidation mechanisms would function correctly under extreme market stress

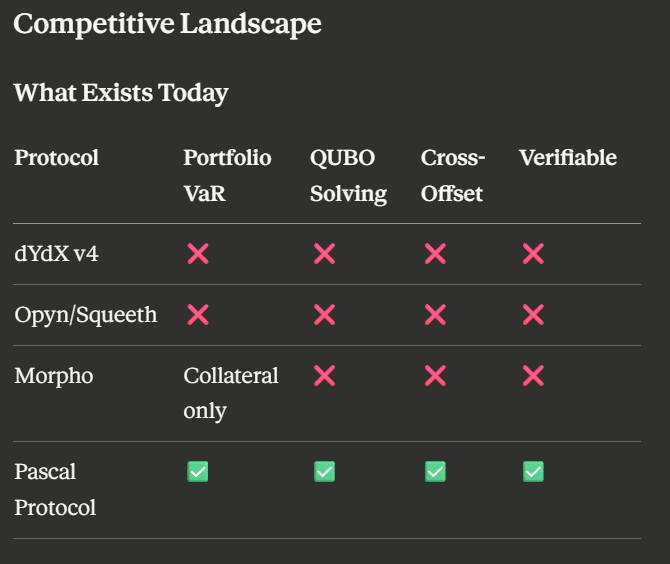

Competitive Landscape

Pascal is the only DeFi protocol combining:

Student-t VaR

QUBO portfolio solver

Bid/offer-aware mark-to-market

Non-linear cross-offset

Verifiable off-chain liquidations

References & Technical Documentation

Academic Foundations

Quantum-Inspired Portfolio Optimisation in the QUBO Framework (Lu et al., 2024)

Systemic Risk and Central Clearing (Duffie, 2011)

ISDA SIMM Standard Initial Margin Model (Industry standard)

CME SPAN and Options Risk Frameworks (Exchange methodology)

Protocol Documentation

Pascal Protocol Technical Specification

CVEX Labs AI Diligence File

Jetstream Platform Documentation

Smart Contract Audit Reports (pending mainnet)

Summary

Pascal Protocol and Jetstream represent a significant technological advancement in decentralised finance infrastructure — the first system capable of providing institutional-grade portfolio margining and clearing for on-chain derivatives markets.

The R&D investment has produced:

Novel QUBO-based real-time risk calculation

First fat-tail VaR implementation on blockchain

Verifiable off-chain computation architecture

Separation of protocol (deterministic) and platform (configurable) layers

This work continues to advance the state of the art in cryptographic financial systems, with ongoing development toward mainnet deployment and broader asset coverage.

Current work includes engaging major trading firms to purchase this IP and continue development to enable tokenised trading of assets to actually start.